Casino Auditing Companies

Companies in this industry operate gambling facilities or offer gaming activities, including casinos, casino resorts and hotels, bingo halls, lotteries, and off-track betting. Major companies include US-based casino operators Caesars Entertainment, Las Vegas Sands, and MGM Resorts, as well as Lottomatica (Italy), SJM Holdings (Hong Kong), Tatts Group (Australia), and William Hill (UK).

Competitive Landscape

Demand for gambling is driven by consumer income growth and state spending. The profitability of individual companies depends on efficient operations and effective marketing. Large operators have the financial resources to make significant investments in facilities and efficient computer operations; they may also enjoy cross-marketing opportunities. Small gambling facilities can thrive by catering to local residents, who may not be able to afford travel to such gambling centers as Las Vegas or Atlantic City. The industry is concentrated: the top 50 gaming companies hold about 60 percent of the market. The casino hotel market is even more concentrated, with the top 50 firms holding 90 percent of the market.

The following is a list of the volumes of the Auditing and Accounting Guide series published by the American Institute of Certified Public Accountants (AICPA). The list was compiled using the resources of the University of Mississippi library. The list also includes titles from the earlier series: AICPA Accounting Guides and AICPA Industry Audit. The Gaming Entities Revenue Recognition Task Force has been created to address issues which may arise due to FASB's new revenue recognition standard. Here you will find the issues identified.

Products, Operations & Technology

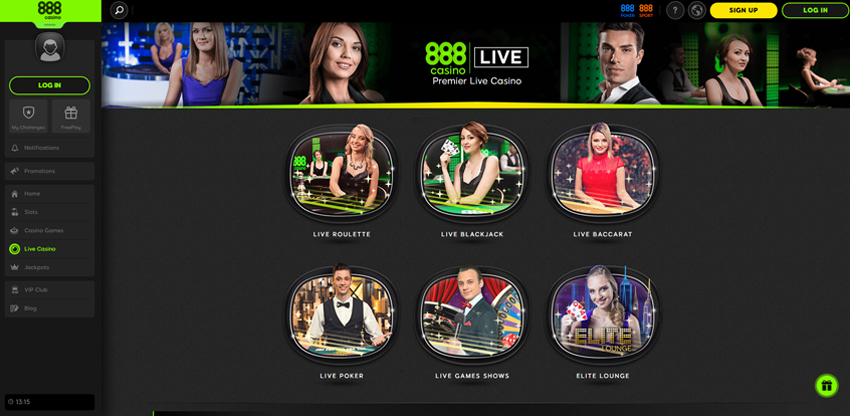

Gaming operators mainly provide a place or a means to play games of chance, where the odds of winning favor the 'house.' Popular casino games are slot machines (slots); video poker; and table games such as roulette, baccarat, blackjack, and craps (dice). The house take on slot machines varies, depending upon the denomination of the slot machine, but generally runs between 5 and 10 percent. The take on most table games may be higher, from 15 to 30 percent. State lottery games are mainly numbers games. State lotteries often retain between 30 and 40 percent of all money bet, according to the National Conference of State Legislatures.This page includes resources for auditing in the gaming industry

Audit Resources

Auditing in the Gaming Industry - PowerPoint presentation

Auditing the Casino Floor: A Handbook for Auditing the Casino Cage Table Games and Slot Operations, 2nd Edition from the IIA

Audit Programs - there are audit programs in our inventory that are available to subscribers. Search on gambling, casinos, gaming etc.

Premium Auditing Companies

Colorado Department of Revenue Gaming Division - downloadable documents for reporting and controlling casino gaming

Compliance Audit Manual - from the Lottery Gaming Commission of Malta

Gaming Audit and Accounting Guide from the AICPA

Internal Auditing Guidelines Recommendations on Internal Auditing for Lottery Operators

AICPA Revenue Recognition Task Forces are charged with developing revenue recognition implementation issues that will provide helpful hints and illustrative examples for how to apply the new Revenue Recognition Standard.

Task Force Members:

- Karl Brunner, Deloitte & Touche LLP (Chair)

- Frank Albarella, KPMG LLP

- Bruce Bleakman, REDW LLC

- Tom Haas, American Casino & Entertainment Properties, LLC

- Kevin Karo, BDO USA LLP

- Richard Lobdell, Osage Casinos

- Sam Marcozzi, Grant Thornton LLP

- Anthony D. McDuffie, Boyd Gaming Corporation

- John Page, PricewaterhouseCoopers LLP

- Patrick Pruitt, Ernst & Young LLP

- Sandra Schulze, International Gaming Technology

- Mike Winterscheidt, Scientific Games Corporation

Insurance Premium Auditing Companies

Feedback Requested

Casino Auditing Companies Inc

Draft Revenue Recognition Implementation Issues included for informal comment, when available, will be listed below.

Casino Auditing Companies Hiring

Respondents should submit any comments including the implementation issue number to kim.kushmerick@aicpa-cima.com by the dates noted below:

Financial Auditing Companies

The Gaming Entities Revenue Recognition Task Force recommends the following AICPA products for current revenue recognition issues: